Audit Under GST

Audit Under GST

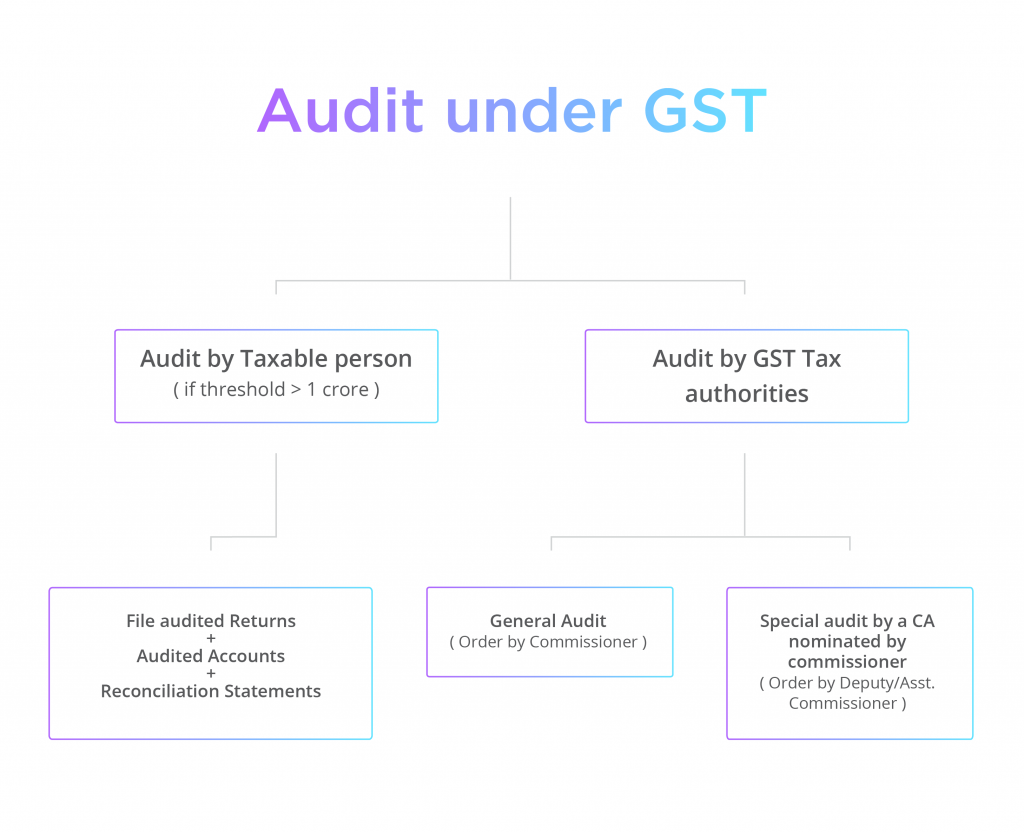

Audit under GST is the process of examination of records, returns and other documents maintained by a taxable person. The purpose is to verify the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and to assess the compliance with the provisions of GST.

Audit under GST is the process of examination of records, returns and other documents maintained by a taxable person. The purpose is to verify the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and to assess the compliance with the provisions of GST.

Threshold for Audit

Every registered taxable person whose turnover during a financial year exceeds the prescribed limit [as per the latest GST Rules, the turnover limit is above Rs 1 crore] shall get his accounts audited by a chartered accountant or a cost accountant. He shall electronically file:

Rectifications after Return Based on Results of Audit under GST

If any taxable person, after furnishing a return discovers any omission/incorrect details (from results of audit), he can rectify subject to payment of interest. However, no rectification will be allowed after the due date for filing of return for the month of September or second quarter, (as the case may be), following the end of the financial year, or the actual date of filing o the relevant annual return, whichever is earlier.

For example, X found during audit that he has made a mistake in Oct 2017 return. X submitted annual return for FY 2017-18 on 31st August 2018 along with audited accounts. He can rectify the Oct 2017 mistake within-

20th Oct 2018 (last date for filing Sep return)

or

31st August 2018 ( the actual date of filing of relevant annual return)

-earlier, ie., his last date for rectifying is 31st August 2018.

Audit by Tax Authorities

Obligations of the Auditee

The taxable person will be required to:

Findings of Audit

On conclusion of an audit, the officer will inform the taxable person within 30 days of:

If the audit results in detection of unpaid/shortpaid tax or wrong refund or wrong input tax credit availed, then demand and recovery actions will be initiated.

Special Audit

When can a special audit be initiated?

The Assistant Commissioner may initiate special audit, considering the nature and complexity of the case and interest of revenue. If he is of the opinion during any stage of scrutiny/enquiry/investigation that the value has not been correctly declared or the wrong credit has been availed then special audit can be initiated.

Special audit can be conducted even if the tax payers books have already been audited before.

Who will order and conduct special audit?

The Assistant Commissioner (with the prior approval of the Commissioner) can order for special audit (in writing). The special audit will be carried out by a chartered accountant or a cost accountant nominated by the Commissioner.

Time limit for special audit

The auditor will have to submit the report within 90 days. This may be further extended by the tax officer for 90 days on an application made by the taxable person or the auditor.

Cost

The expenses for examination and audit including the auditor’s remuneration will be determined and paid by the Commissioner.

Findings of special audit

The taxable person will be given an opportunity of being heard in findings of the special audit.

If the audit results in detection of unpaid/shortpaid tax or wrong refund or input tax credit wrongly availed then demand and recovery actions will be initiated.

Thus, GST is a completely new tax regime already taking India by storm. Businesses will face challenges in transition and application of GST. To know more about GST, feel free to read more of our articles on our blog.